north carolina sales tax rate on food

North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275There are a total of 459 local tax jurisdictions across the state collecting an average local tax of 222. Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply Manufactured and Modular Homes.

Sales Tax On Grocery Items Taxjar

You can print a 725 sales tax table here.

. You own a grocery store in Murphy NC. The sales tax rate on food is 2. Average Sales Tax With Local.

The State of North Carolina charges a sales tax rate of 475. Aircraft and Qualified Jet Engines. 675 Is this data incorrect Download all North Carolina sales tax rates by zip code.

Sales and Use Tax NCDOR. This page describes the taxability of food and meals in North Carolina including catering and grocery food. According to North Carolina law youd be required to charge.

The Asheville sales tax rate is. The Forsyth County North Carolina sales tax is 675 consisting of 475 North Carolina state sales tax and 200 Forsyth County local sales taxesThe local sales tax consists of a 200 county sales tax. If you are looking for additional detail you may wish to utilize the Sales Tax Rate Databases which are provided in.

Combined with the state sales tax the highest sales tax rate in North Carolina is. The North Carolina sales tax rate is currently. Showing 1 to 6 of 6 entries.

Some rates might be different in New Hanover County. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax.

Walk-ins and appointment information. 725 Is this data incorrect The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

The 2018 United States Supreme Court decision in South Dakota v. Ergo they are food. NCDOR Taxes Forms Sales and Use Tax.

Counties and cities in North Carolina are allowed to charge an additional local sales tax on top of the North Carolina state sales tax. 725 Sales and Use Tax Chart. Did South Dakota v.

Non-Qualifying Food Dietary Supplements Food Sold Through a Vending machine Prepared Food Certain Bakery Items Soft Drinks Candy. To learn more see a full list of taxable and tax-exempt items in North Carolina. The County sales tax rate is.

Appointments are recommended and walk-ins are first come first serve. Wayfair Inc affect North Carolina. The North Carolina sales tax rate is currently.

Mecklenburg County Health Department 980 314-1620. Has impacted many state nexus laws and sales tax collection requirements. North Carolinas sales tax rates for commonly exempted categories are listed below.

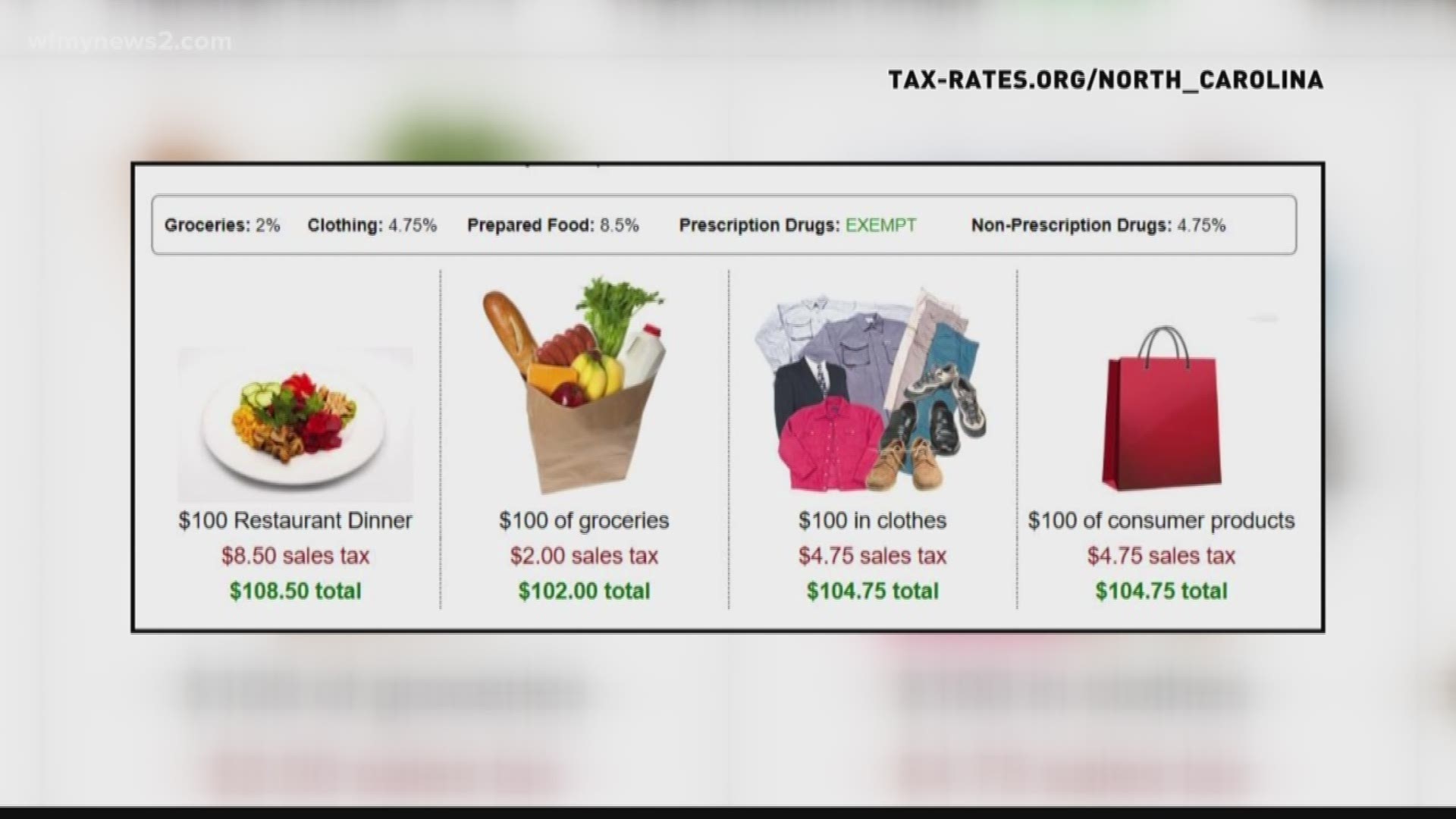

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Note that in some areas items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general purchases. With local taxes the total sales tax rate is between 6750 and 7500.

35 rows Alexander. This means that depending on your location within North Carolina the total tax you pay can be significantly higher than the 475 state sales tax. In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax.

A customer buys a toothbrush a bag of candy and a loaf of bread. Click here for a larger sales tax map or here for a sales tax table. North Carolina has recent rate changes Fri Jan 01 2021.

There is no applicable city tax. The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants. Prepared Food and Beverage Return and Instructionspdf One percent 1 of the sales derived from prepared food and beverages sold is assessed at retail for consumption on or off the premises are assessed by any retailer within the County that is subject to sales tax imposed by the State of North Carolina.

The County sales tax rate is. 31 rows North Carolina NC Sales Tax Rates by City North Carolina NC Sales Tax Rates by City The state sales tax rate in North Carolina is 4750. Union County collects a 2 local sales tax the maximum local sales tax.

Qualifying Food A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. The Buncombe County Sales Tax is collected by the merchant on all qualifying sales made within Buncombe County. 2 Food Sales and Use Tax Chart.

Do you charge sales tax on shipping in North Carolina. 75 Sales and Use Tax Chart. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

This is the total of state county and city sales tax rates. Candy however is generally taxed at the full combined sales tax rate. Prepared Food Beverage.

The Buncombe County North Carolina sales tax is 700 consisting of 475 North Carolina state sales tax and 225 Buncombe County local sales taxesThe local sales tax consists of a 225 county sales tax. 92 out of the 100 counties in North Carolina collect a local surtax of 2. Is Food Taxable In North Carolina Taxjar Back to North Carolina Sales Tax Handbook Top.

Higher sales tax than 98 of North Carolina localities 025 lower than the maximum sales tax in NC The 725 sales tax rate in Charlotte consists of 475 North Carolina state sales tax 2 Mecklenburg County sales tax and 05 Special tax. The transit and other local rates do not apply to qualifying food. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

The Welcome sales tax rate is. County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted By 5-Digit Zip. Sales taxes are not charged on services or labor.

The minimum combined 2022 sales tax rate for Welcome North Carolina is. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. North Carolina has a 475 statewide sales tax rate but also has 459 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 222 on top of the state tax.

Is Food Taxable In North Carolina Taxjar

Is Food Taxable In North Carolina Taxjar

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Column Five Media Turbotax Infographic America S Most Bizarre Taxes

North Carolina Sales Tax Small Business Guide Truic

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Florida Taxes Florida County Map Map Of Florida Florida Beaches

Is Food Taxable In North Carolina Taxjar

States With Highest And Lowest Sales Tax Rates

Pin By Lee Kifer On County Counties In 2022 County Map South Carolina Upstate South Carolina

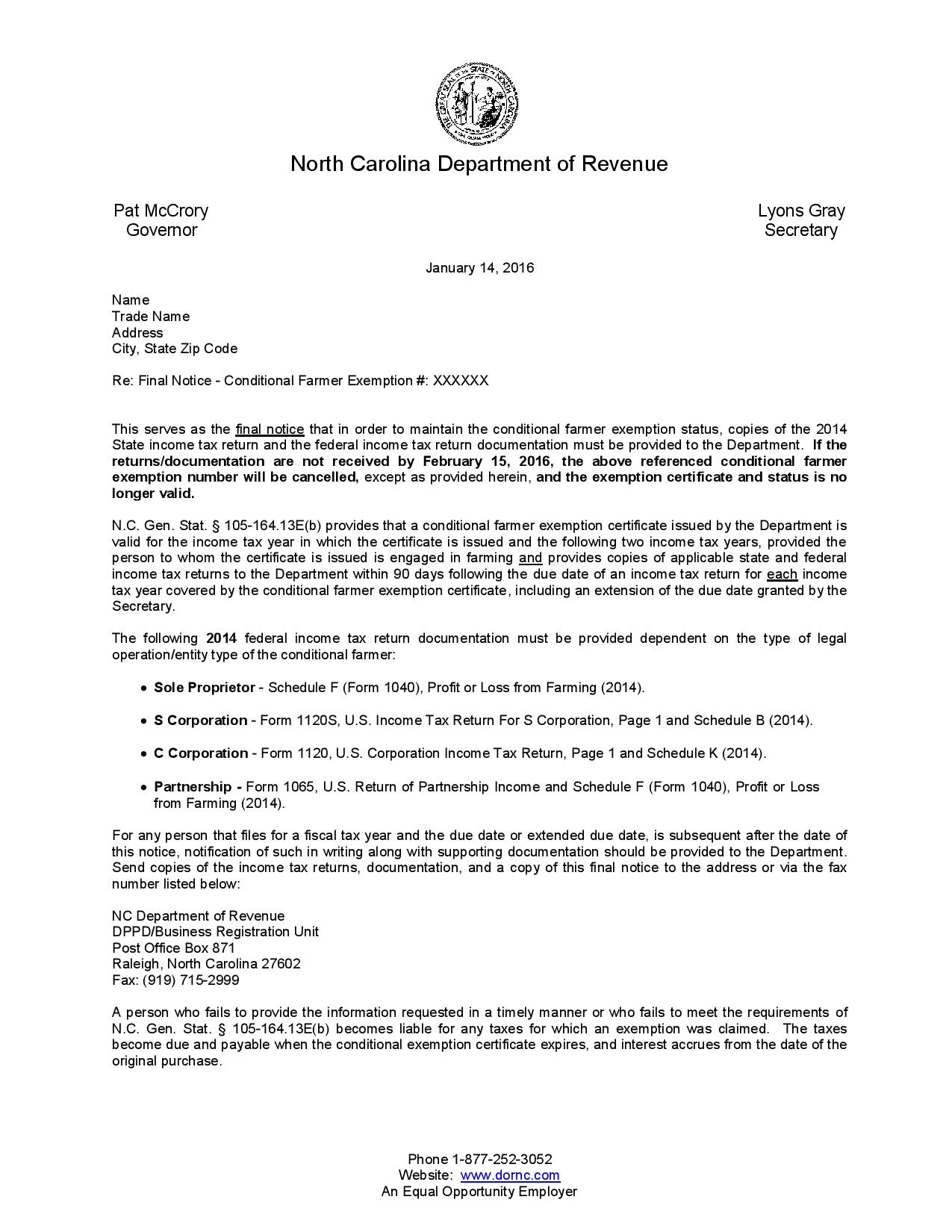

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

The Most Common Tax Mistakes Infographic Income Tax Income Tax Return Tax Consulting

What Ocean Beaches Are Closest To Kentucky Beach Close Ocean Beach South Carolina

North Carolina Sales Tax Rates By City County 2022

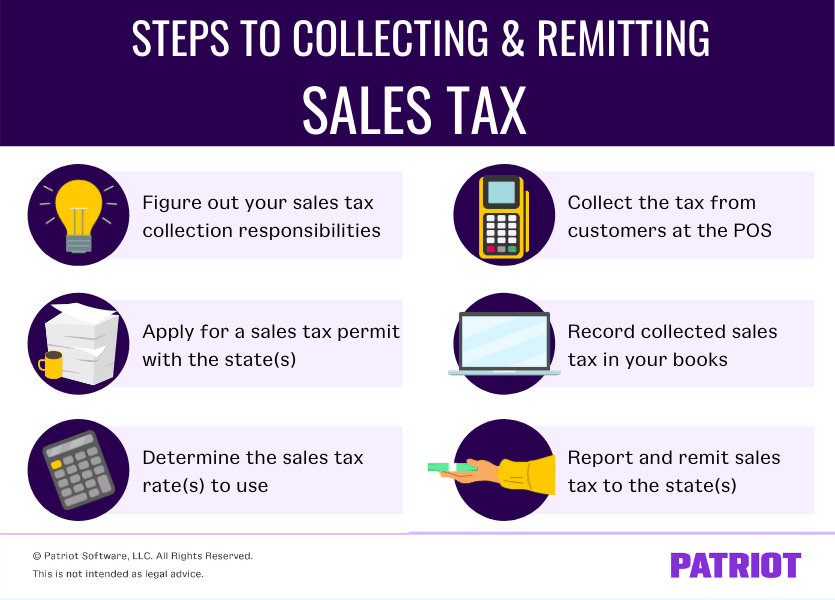

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Composition Of State And Local Tax Rev Income Tax Government Taxes Revenue

Is Food Taxable In North Carolina Taxjar

How A Taxpayer May Obtain A Sales Tax Refund Zip2tax News Blog Tax Refund Sales Tax Refund